In the fast moving universe of cryptocurrency, few projects have captured attention quite like Solana (SOL). Launched in 2020, it promised what many networks struggled to deliver: lightning-fast transactions, minimal fees, and a robust platform for developers to build all kinds of decentralized applications (dApps). From NFT marketplaces to blockchain-based games, SOL quickly earned a reputation as the “speed demon” of crypto.

But as with any ambitious project, the journey has been far from smooth. Investors have witnessed dizzying highs, sudden price dips, and moments of doubt that tested confidence in the Solana cryptocurrency. As SOL continues to evolve and its ecosystem expands, many crypto enthusiasts and investors are asking the same burning question: Could Solana really reach $1000?

Table of Contents

The Early Days: Fast Start, Bumps Ahead

Solana arrived in the crypto scene when many other blockchains were struggling with slow transaction speeds and high fees. Bitcoin, the pioneer of digital currency, was secure but painfully slow, while Ethereum offered smart contracts but became congested and expensive during peak usage. Solana aimed to combine the best of both worlds. Its protocol could handle tens of thousands of transactions per second, while keeping fees almost negligible. For developers and investors frustrated with slow, costly networks, Solana felt like a dream come true.

By 2021, the network’s potential became impossible to ignore. SOL, it’s native token, surged to nearly $260, riding the crypto boom. NFT creators flocked to it for fast and low-cost minting, gamers loved the high-performance apps, and investors enjoyed rapid growth. Yet this glory period wasn’t without drama. Network outages, spam attacks, and technical bugs occasionally spooked the community. The collapse of FTX, a major backer, sent SOL plummeting to around $8–$10, reminding everyone that cryptocurrency markets can never be predicted.

What Makes Solana Special?

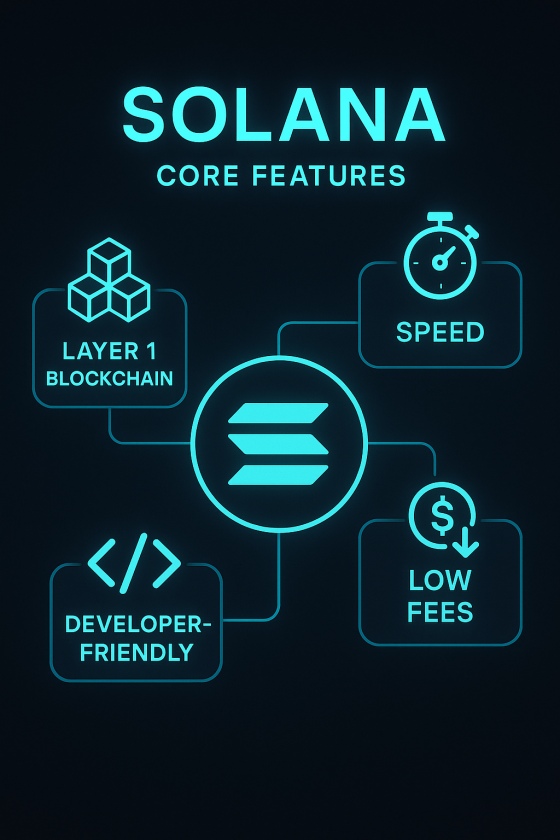

To actually understand why SOL has captivated crypto enthusiasts, it’s important to examine its core features:

- Blazing Speed: Solana can process up to 65,000 transactions per second (TPS). To visualize that, you could run an entire NFT marketplace at full capacity and still have bandwidth to spare. Transactions that take minutes or cost hundreds on other networks happen almost instantly on Solana.

- Ultra-Low Fees: Sending SOL or trading NFTs doesn’t drain wallets. This makes Solana ideal for both small and large transactions.

- Developer-Friendly Ecosystem: From gaming to DeFi platforms and NFT applications, Solana provides a scalable environment where developers can innovate.

- Layer 1 Blockchain: Everything, smart contracts, token transfers, and decentralized apps, runs directly on Solana’s main chain, giving it a robust foundation for a growing ecosystem.

These aren’t just tech specs, they define how investors and users experience the network daily, influencing adoption, price perception, and long-term growth and make predictions more viable.

Why Solana’s Price Can Swing Wildly?

SOL’s price is notoriously volatile, sometimes resembling a heartbeat monitor rather than a predictable asset. Several factors contribute to this:

Global Economic Conditions: Despite being decentralized, SOL can react to macroeconomic factors. Inflation, market downturns, or shifts in traditional finance indirectly affect cryptocurrency investors’ decisions.

Market Sentiment: Unlike stocks tied to earnings or fiat currencies influenced by central banks, SOL is highly influenced by public perception. Tweets from influencers, media coverage, or sudden regulatory announcements can make SOL skyrocket or tumble within hours.

Speculation: Many investors treat SOL as a short-term opportunity rather than a long-term holding. Mass sell-offs during uncertainty can amplify price drops.

Regulatory Changes: Governments and financial authorities are still figuring out cryptocurrency frameworks. Announcements of restrictions or changes, especially in key markets like China, India, or the EU, can trigger rapid market reactions.

Technical Challenges and Network Updates: Protocol upgrades or disagreements within the community can create uncertainty. Forks, outages, or bugs may temporarily affect investor confidence.

How People Actually Use Solana?

Solana isn’t just a coin people trade for profit, it’s a platform teeming with activity.

- Trading SOL: The basic approach is buy low, sell high. Many traders try to capitalize on its’s price swings.

- NFTs: Artists, musicians, and collectors flock for low-cost minting and trading. Digital collectibles range from art to music to in-game items.

- DeFi Activities: Users can lend, borrow, stake, or yield farm, allowing them to earn passive income or leverage their crypto holdings.

- Gaming and dApps: High-speed blockchain games and decentralized applications thrive on Solana, drawing in users who want seamless interactions and minimal lag.

The network’s versatility is a key part of why so many continue to watch it closely.

Surviving the Volatility: Tips for Investors

Since we actually saw the how volatile it actually is, despite a analysis, it might just go beyond anticipated. Investing in Solana, or any crypto, isn’t just about luck. It requires strategy, awareness, and patience.

- Stay Educated: Keep up with tech updates, news, and regulatory developments. Knowledge reduces panic driven decisions.

- Diversify: Don’t focus solely on SOL. Spreading investments across different cryptocurrencies can help mitigate risk.

- Pick Your Style: Long-term holding (HODLing) allows investors to ride out volatility, while active trading can capitalize on short-term swings. Know your tolerance.

- Engage with Communities: Online forums and news platforms provide real-time insights, but always verify before acting.

- Invest Responsibly: Only risk what you can afford to lose. It is promising, but like all crypto, it’s unpredictable.

Could Solana Ever Reach $1000?

Here’s the million-dollar question: Can Solana realistically hit $1000?

Optimists believe it’s possible. Widespread adoption, new apps, continued ecosystem growth, and a strong crypto market could all push SOL higher. Increased trust in the network and more use cases, from gaming to DeFi, would naturally drive demand.

Skeptics caution that network outages, regulatory hurdles, and competition from Ethereum and emerging blockchains might limit its growth. Even with blazing speed and low fees, it has challenges to overcome if it wants to reach that mythical $1000 price point.

Realistically, a $1000 Solana is a long-term prospect. It will require sustained adoption, technological improvements, and a favorable market environment. But if it continues to innovate and capture attention, that target isn’t completely out of reach.

Solana’s journey has been fast, dramatic, and full of lessons. From ambitious beginnings to technical challenges, meme-driven rallies, and ecosystem growth, it has become one of the most talked-about blockchains in the crypto world.

While the path to $1000 may be uncertain, it’s speed, low fees, and developer-friendly environment make it a platform worth watching. For investors, developers, and crypto enthusiasts alike, Solana is a living example of the thrilling, unpredictable, and transformative power of blockchain technology.

Stay curious, stay informed, and enjoy the ride, Solana’s story is far from over.

Apart from speculation and analogy you can actually learn from Solana’s official site and for similar information, LoginAid is here for you.

- 6 Best Facebook Games You Can Play With Friends Today - January 25, 2026

- 4 Best Food Delivery Apps in the US: Fast, Fun & Full of Flavor - January 1, 2026

- Best 5 Travel Booking Sites to Use : Flights And Hotels On Fingertips - December 28, 2025